In the fast-paced world of finance, proprietary trading, commonly known as prop trading, has gained significant attention and popularity. But what exactly is prop trading, and why is it becoming such a sought-after practice among traders and financial firms? This article delves into the core of prop trading, explores the role of prop trading firms, and uncovers the reasons behind its rising popularity.

Understanding Prop Trading: Prop Trading definition

Proprietary trading, or prop trading understanding, refers to the practice where a financial firm or commercial bank invests its own money in the financial markets, rather than using clients’ money. The primary objective of prop trading is to generate profits for the firm through the buying and selling of financial instruments such as stocks, bonds, currencies, commodities, and derivatives.

However, prop trading isn’t the only avenue available for traders seeking to leverage external capital. If you’ve heard of funded trading, you might wonder, what is funded trading, and how it compares to proprietary trading. While prop trading involves firms trading with their own funds, funded trading provides traders access to a firm’s capital in exchange for profit-sharing agreements, often requiring traders to pass evaluation challenges to prove their skills.

Unlike traditional trading, where brokers execute trades on behalf of clients and earn commissions, prop traders use the firm’s capital to take positions in the market. The profits (and losses) from these trades directly impact the firm’s bottom line. This creates a high-risk, high-reward environment, where skilled traders can earn substantial returns.

The role of Prop Trading firms

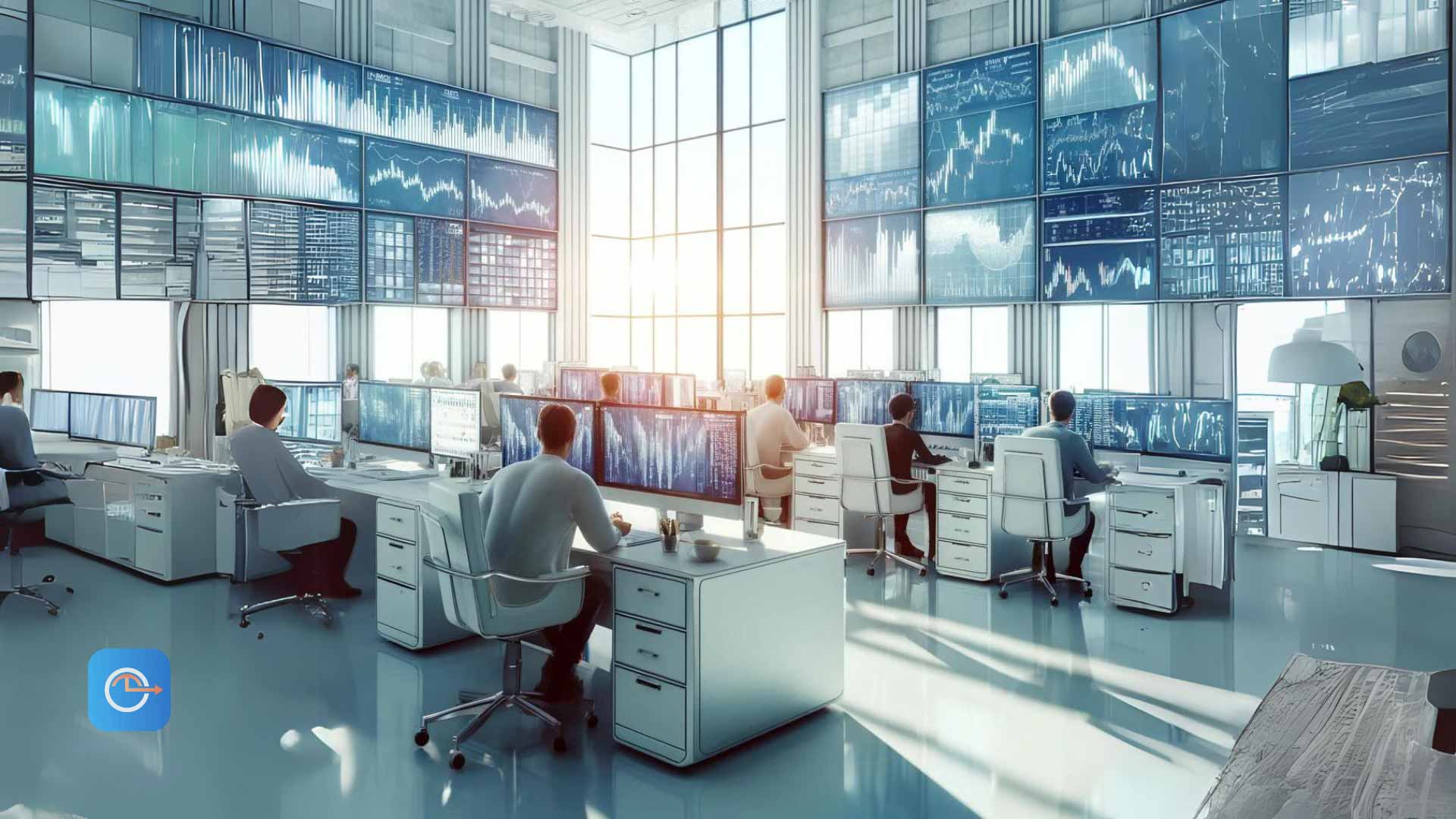

Prop trading firms are specialized institutions that engage in proprietary trading. These firms employ traders to trade the firm’s capital and often provide them with sophisticated trading platforms, analytical tools, and access to substantial financial resources. Prop trading firms differ from hedge funds and mutual funds, which primarily manage clients’ assets.

These firms typically have rigorous recruitment processes, selecting only the most talented and experienced traders. Successful prop traders can earn significant bonuses and profit-sharing agreements, making it an attractive career option for many in the finance industry. If you’re interested in challenge trading you can test your skills and getting funded, register now !

Why Prop Trading is popular today

Several factors contribute to the growing popularity of prop trading in today’s financial landscape:

- Potential for High Profits: Prop trading offers the potential for significant financial gains. With access to substantial capital and advanced trading tools, skilled traders can exploit market opportunities and generate impressive returns. This potential for high profits attracts top talent to the industry.

- Control and Independence: Prop traders have more control over their trading strategies compared to traders working for traditional financial institutions. They are not bound by client constraints and can take larger positions, allowing for more aggressive trading strategies. This independence appeals to traders who prefer a more autonomous trading environment.

- Advanced Technology: Prop trading firms invest heavily in technology, providing traders with state-of-the-art trading platforms and analytical tools. The use of algorithms, artificial intelligence, and machine learning enhances trading efficiency and decision-making. This technological edge gives prop traders a competitive advantage in the market.

- Market Volatility: Financial markets have become increasingly volatile in recent years due to geopolitical events, economic uncertainties, and global pandemics. Volatility creates opportunities for prop traders to profit from rapid price movements. The ability to adapt quickly to changing market conditions is a key reason why prop trading has gained traction.

- Regulatory Environment: Changes in financial regulations have also contributed to the rise of prop trading. After the 2008 financial crisis, many banks reduced their proprietary trading activities due to stricter regulations. This shift allowed independent prop trading firms to fill the gap and capitalize on market opportunities.

- Career Opportunities: For traders, working at a prop trading firm offers lucrative career prospects. The potential for high earnings, coupled with the opportunity to trade significant capital, makes it an appealing career path. Additionally, the entrepreneurial nature of prop trading allows traders to continuously innovate and refine their strategies.

Challenges in Prop Trading

While prop trading offers numerous benefits, it is not without its challenges. The high-risk nature of prop trading means that traders can also incur significant losses. Firms must implement robust risk management practices to mitigate potential losses. Additionally, the competitive environment requires continuous learning and adaptation to stay ahead in the market.

Risk management

Effective risk management is crucial in prop trading. Firms and traders must develop comprehensive strategies to manage risk, including setting stop-loss limits, diversifying trading portfolios, and maintaining adequate liquidity. Without proper risk management, even the most promising trading strategies can result in substantial losses.

Continuous learning

The financial markets are dynamic, constantly influenced by a myriad of factors such as economic data releases, political events, and technological advancements. Prop traders need to stay informed and continuously update their knowledge and skills. This involves regular training, attending industry seminars, and staying abreast of market trends and developments.

Psychological challenges

The high-stakes nature of prop trading can lead to significant psychological stress. Traders must maintain a disciplined mindset, manage their emotions, and avoid impulsive decisions. The ability to handle pressure and stay focused is essential for long-term success in prop trading.

Conclusion

Prop trading has emerged as a prominent force in the financial world, attracting skilled traders and generating substantial profits. The combination of advanced technology, market volatility, and the potential for high earnings has made prop trading an appealing option for many in the finance industry. As the financial markets continue to evolve, the popularity of prop trading is likely to persist, driven by innovation, independence, and the relentless pursuit of market opportunities.

By understanding the dynamics of prop trading and the factors contributing to its rise, traders and financial firms can better navigate this exciting and challenging domain. As always, success in prop trading requires not only talent and technology but also a disciplined approach to risk management and continuous learning.

Whether you are a seasoned trader or a beginner looking to break into the industry, prop trading offers a unique and potentially rewarding career path. Embrace the challenges, stay informed, and continuously refine your strategies to make the most of the opportunities in this dynamic field.

Signup right now and be a successful trader without risking your own capital!